For yrs, Meghan Neri compensated $30 apiece for packages of epinephrine car-injectors for her two adolescent children with foodstuff allergic reactions. The price for four packs of the lifesaving medicine was a workable $120 a calendar year.

So Neri, 42, of Scituate, Massachusetts, was shocked when, in 2019, her loved ones pharmacist stated that each automobile-injector pack would price tag $600.

Her out-of-pocket price tag for the 12 months experienced skyrocketed to $2,400.

The price tag of the epinephrine pictures on their own experienced not risen. The issue was the Neris experienced switched to a new, superior-deductible well being insurance policy approach to conserve revenue. Month to month payments are lessen with substantial-deductible courses, but people need to pay out countless numbers of dollars just about every 12 months right before quite a few fees — often which includes epi automobile-injectors — are included.

Like the Neris, quite a few households are caught off guard by the jump in cost. Some are forced to ration the car-injectors or go without having them.

“Many family members have opted not to choose up their EpiPens mainly because they just can’t afford to pay for it,” mentioned Dr. Purvi Parikh, an allergist and immunologist at NYU Langone Health in New York Town. “They’re using the probability that, God forbid, a lousy end result will manifest.”

Parikh claimed families have experienced to shoulder extra and a lot more financial duties about the earlier 10 years, notably as large-deductible insurance policy programs have turn into much more prevalent.

The 2010 Reasonably priced Treatment Act expanded accessibility to health and fitness coverage, so organizations were being faced with covering extra individuals than at any time right before. To compensate, insurers “not only elevated how a lot it expenses to be covered, but they’ve pushed a lot more of that out onto the client in the variety of large-deductible programs,” Parikh claimed. “We’ve been viewing this each individual solitary calendar year for at the very least the final seven to 10 decades.”

An examination by KFF, also regarded as the Kaiser Spouse and children Basis, discovered that in 2009, 17{6f90f2fe98827f97fd05e0011472e53c8890931f9d0d5714295052b72b9b5161} of workers have been enrolled in a overall health plan with an once-a-year deductible of at minimum $1,000. By 2021, it was 50{6f90f2fe98827f97fd05e0011472e53c8890931f9d0d5714295052b72b9b5161}.

“The regular deductible in employer-centered wellness insurance now is around $1,700 for every human being,” claimed Larry Levitt, government vice president of KFF.

With some household plans, deductibles can soar nicely around $3,000.

“What it signifies is that even when you are insured, you may well not really be shielded from likely catastrophic overall health care expenses,” Levitt said.

Prescriptions that earlier price tag no much more than $30 or so — a standard copay — are now full rate, which can soar into hundreds of bucks.

Some medicines, this sort of as medications to command higher blood stress, are lined even right before the deductible is achieved. But the epinephrine vehicle-injectors — which produce a shot of epinephrine and are the only unexpected emergency medication accessible for daily life-threatening allergic reactions — usually are not.

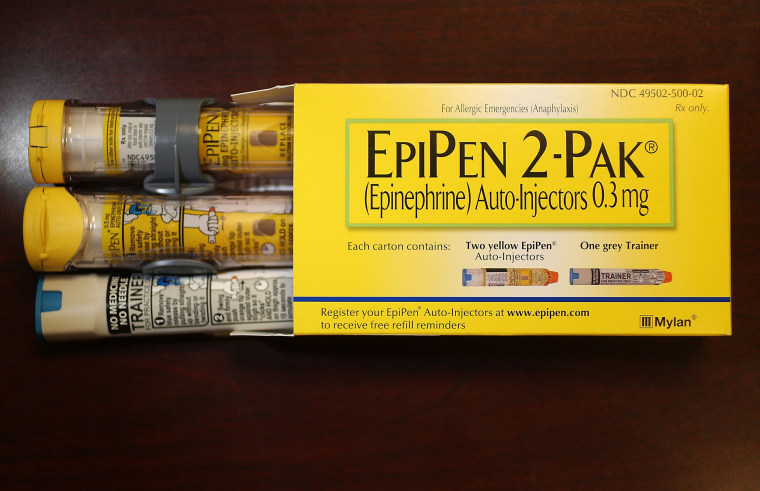

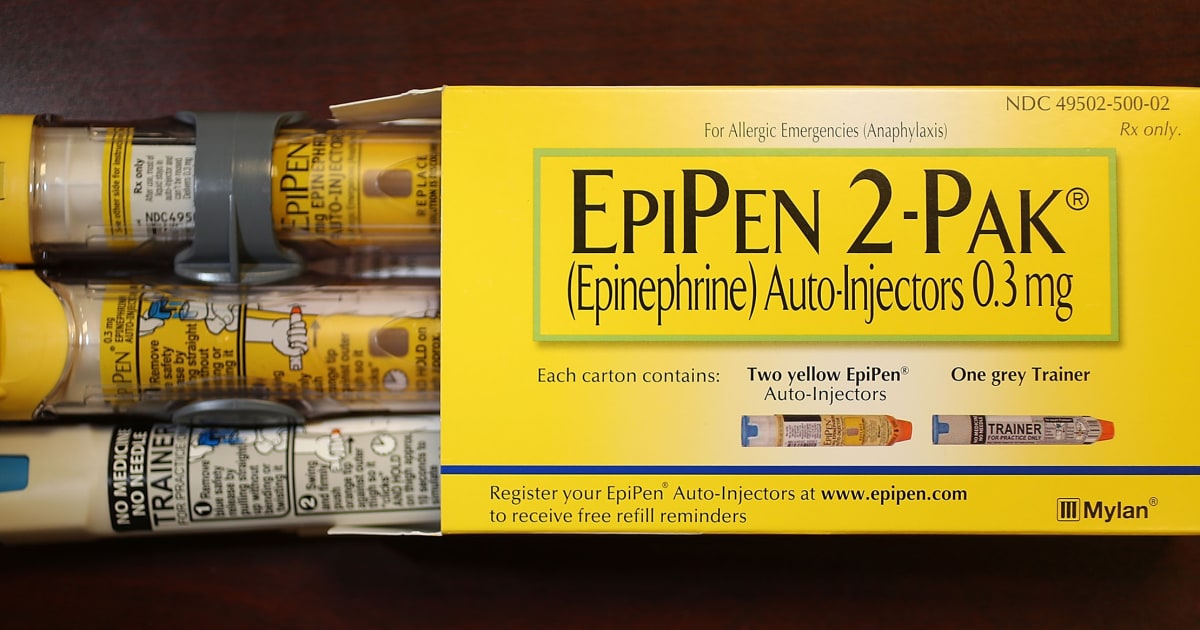

Handful of prescription prescription drugs or equipment symbolize out-of-manage overall health care costs far more than EpiPen.

From 2008 to 2016, Mylan pharmaceutical enterprise elevated the selling price of its auto-injectors by a lot more than 400{6f90f2fe98827f97fd05e0011472e53c8890931f9d0d5714295052b72b9b5161}, major to public outrage and congressional scrutiny.

Other epinephrine-providing items soon emerged, these as Adrenaclick and Auvi-Q, alongside with generics, with the hope of developing costs more people could afford to pay for. It labored, to a level.

“The total that privately insured sufferers experienced to spend out of pocket did lessen,” explained Dr. Kao-Ping Chua, an assistant professor of pediatrics at the University of Michigan Health care School and the Susan B. Meister Little one Wellbeing Evaluation and Investigation Centre in Ann Arbor, Michigan.

Aspect results: Far more on drug expenditures in the U.S.

But just after switching to a substantial-deductible prepare, some clients like the Neris found out they had been charged just about whole cost for epinephrine vehicle-injectors.

Neri’s daughter, Shea, 14, has a milk allergy, and her son, Thomas, 12, is allergic to milk, peanuts and tree nuts. They do not leave house with out the products nestled into a tiny fanny pack they put on at all instances — just in circumstance of an publicity.

“You hope that it’s squandered medication and squandered electricity,” Neri mentioned.

The injectors are only fantastic for a single yr, on normal. The Neri relatives must purchase four auto-injector packs for the two young children every single 12 months to preserve in their home and schools. Shea and Thomas have each had to use the crisis epinephrine shots.

When the pharmacist advised Neri the new selling price for the refills, she was devastated and did not pay the $2,400 that working day.

“It was a tiny embarrassing to say, ‘I cannot do this appropriate now,’” she claimed.

Deductibles are supposed to discourage poor use of professional medical care and abuse of prescription medicine, Levitt claimed. But epinephrine automobile-injectors save people’s life.

“No a person is making use of them inappropriately,” he said.

In fact, Neri mentioned the vehicle-injectors are essential equipment to safeguard her small children.

Individuals really don’t anticipate to pay back this a great deal when they have wellbeing insurance policies.

Pediatrician Dr. Kao-Ping Chua, University of Michigan Professional medical College

“This is not a preference. Absolutely nothing about this is a choice,” she reported.

Epinephrine is the to start with line of defense when a person has a intense allergic response, named anaphylaxis. When this takes place, blood force plummets. Airways narrow, producing it hard to breathe. A shot of epinephrine, or adrenaline, can reverse what could in any other case be fatal.

“For large-benefit, lifesaving remedies, there must be zero cost out of pocket,” mentioned Chua, of the College of Michigan.

Chua has used yrs learning how substantially family members pay out for emergency epinephrine. He led a analyze released in July that uncovered 1 in 13 people were paying out extra than $200 a year for their epinephrine automobile-injectors.

Most were small children, in component because allergic reactions are much more commonplace in youngsters than grown ups, but also because they will need many auto-injectors to retailer at house, at school and throughout soon after-school pursuits.

A vast majority of the family members paying much more than $200 a year in Chua’s research — 62.5{6f90f2fe98827f97fd05e0011472e53c8890931f9d0d5714295052b72b9b5161} — have been enrolled in higher-deductible wellness strategies.

“I watch this primarily as a issue of insurance plan profit design,” Chua reported. “People really do not assume to shell out this a great deal when they have wellness coverage because they believe that coverage will deal with the medication.”

Individuals can query higher rates

“It’s ordinarily up to insurers — and companies in the situation of place of work health and fitness added benefits — whether or not any wellbeing treatment solutions and medications are exempt from the deductible,” Levitt said.

Well being insurance policies firms could exempt epinephrine vehicle-injectors from their high deductibles. UnitedHealthcare announced that starting off next yr, there will be no copay or other out-of-pocket expenses for epinephrine on some of its ideas.

It’s the only main wellbeing insurance policies enterprise to deal with epinephrine so much, but “we are significantly viewing a trend in direction of insurance coverage businesses waiving out-of-pocket fees for people for medicines that are lifesaving,” Levitt reported.

Chua explained it would be very good community plan to limit the expense of other lifesaving drugs, way too, this sort of as insulin for diabetic issues and naloxone to reverse opioid overdoses.

But AHIP (previously regarded as America’s Wellbeing Insurance policy Strategies), a team that represents these types of providers, reported drug manufacturers are to blame.

“We motivate Large Pharma to end their selling price gouging methods and reduced their out-of-handle selling prices for patients,” the group reported in a statement to NBC News. “Patients require their everyday living-preserving remedies, so a lack of medication possibilities signify that Large Pharma has no incentive to agree to reduce rates.”

Ultimately, navigating wellbeing designs and scrambling to determine out means of paying out for highly-priced medications is remaining to patients.

“The most significant issue to know is regardless of whether or not they have to spend a deductible for drugs just before coverage protection takes place,” Chua claimed.

Soon after that working day in the pharmacy, Neri took a close appear at her family’s wellness insurance plan strategy and contacted their physician to chat through other solutions.

They switched to a various brand name of crisis epinephrine and now spend $25 for every pack.

“We were being going to shell out what we necessary to keep them safe and sound,” Neri mentioned. “But it’s handy to have sufficient facts to make an educated selection and not experience like you are throwing dollars absent unnecessarily.”

Levitt reported that individuals need to truly feel empowered to concern large price ranges.

“It’s a good deal of perform,” Levitt stated, but “if you are confronted with a statements denial, if you are faced with a large price, battle it. Battle it with your health and fitness treatment supplier, combat it with your insurance firm.”

“No practically by no means usually means no in overall health insurance,” he reported. “You can typically earn.”

More Stories

Empowering Independence: Enhancing Lives through Trusted Live-In Care Services

Major Mass., NH health insurance provider hit by cyber attack

Opinion | Health insurance makes many kinds of hospital care more expensive