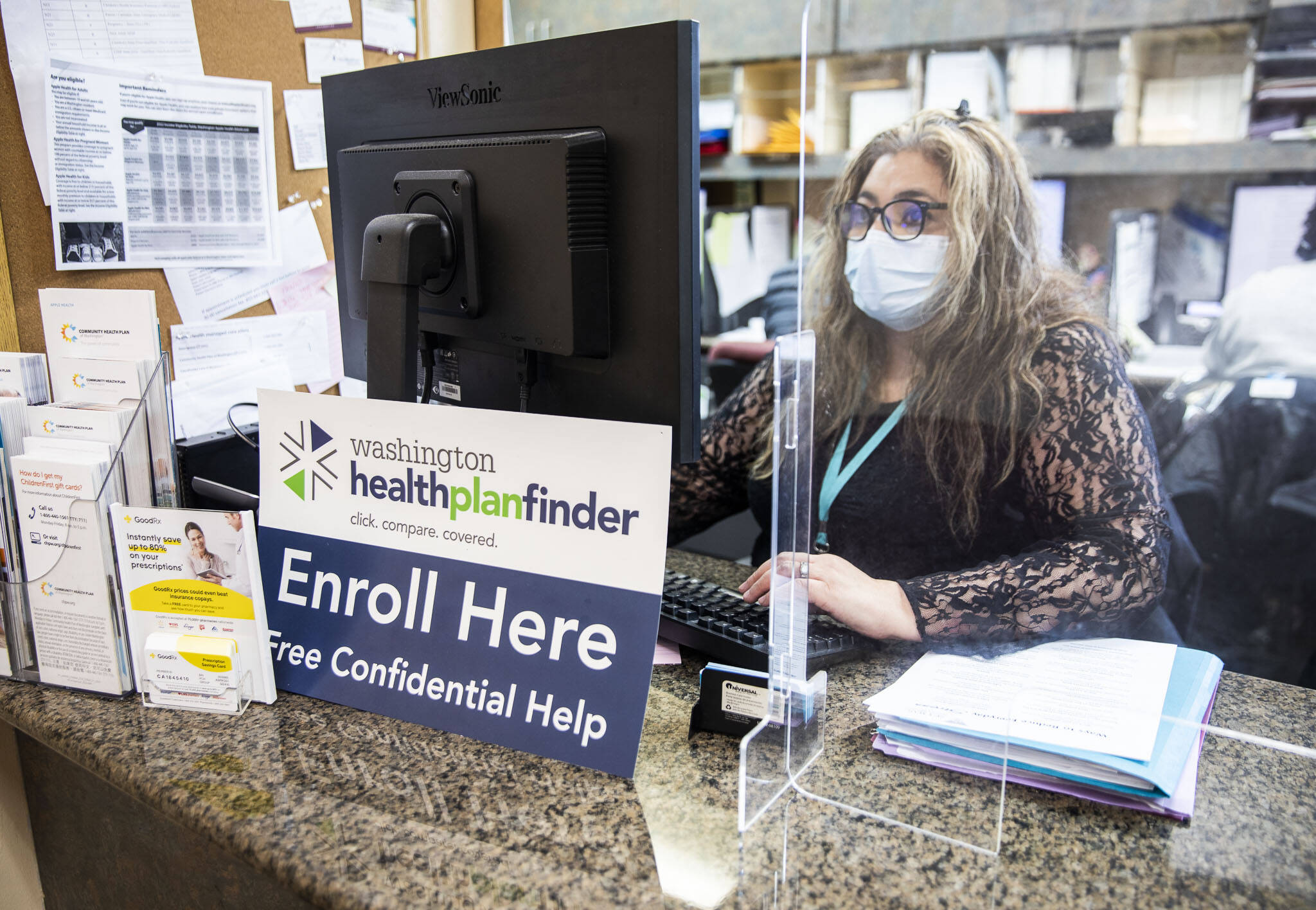

Annaberies Colmena, a individual navigator, sits behind an open enrollment flyer at Sea Mar on Dec. 9, in Everett. (Olivia Vanni / The Herald)

EVERETT — In 2023, some individuals could spend very little in monthly premiums for a Cascade Treatment Savings wellbeing system.

It’s not too fantastic to be to real, verified Ana Howe, managed care regional coordinator for Sea Mar Group Health Middle. Their health system navigators have by now signed people up for $ on the Washington Healthplanfinder, the state’s wellbeing rewards exchange.

The improved condition tax credits for individuals earning up to 250{6f90f2fe98827f97fd05e0011472e53c8890931f9d0d5714295052b72b9b5161} of the federal poverty level is just a person of various alterations for following 12 months for persons who purchase wellness insurance policy on the exchange.

Simply because of that modify on your own, Howe emphasised that people by now enrolled in an exchange plan should not automobile-renew with no exploring their solutions on Healthplanfinder. The condition just lately approximated that 90{6f90f2fe98827f97fd05e0011472e53c8890931f9d0d5714295052b72b9b5161} of trade prospects in Snohomish County could locate a cheaper system with the same stage of protection. Other counties in the north Puget Seem area, like Island, San Juan, Skagit and Whatcom, ranged from 69{6f90f2fe98827f97fd05e0011472e53c8890931f9d0d5714295052b72b9b5161} to 77{6f90f2fe98827f97fd05e0011472e53c8890931f9d0d5714295052b72b9b5161}.

Individuals customers’ latest plans may possibly not qualify for the added tax credits.

Following 12 months, a house of a few earning much less than $54,900 per year would qualify for some assistance with a Cascade Care approach. The point out mentioned in a press release that “Cascade Treatment Discounts enables most qualified consumers to get a large-high-quality approach for significantly less than $10 a month.”

Even even though the very first exchange open up enrollment deadline is looming — Dec. 15 for protection beginning Jan. 1, 2023 — persons can signal up as late as Jan. 15, 2023, for protection commencing Feb. 1.

Virtually 21,000 individuals in Snohomish are enrolled in a qualified wellness approach on the exchange, and a different 173,000 are enrolled in Apple Health and fitness, the state’s Medicaid software, according to tumble 2022 facts from the Washington Wellness Benefit Exchange.

Apple Well being is often open up for enrollment. Young children under 18 and expecting women can get coverage via Apple Wellness, irrespective of their immigration position. And automated renewals keep on being in outcome for as prolonged as the federal COVID general public wellbeing unexpected emergency carries on.

Howe and other navigators have been out at local community functions, ready with their laptops to help folks enroll in overall health protection on the spot. Howe was at the Evergreen branch of the Everett General public Library on Wednesday and the Everett Goodwill career and education middle on Thursday.

Sea Mar can link people with navigators and brokers in numerous languages, these types of as Russian, Punjabi and Spanish. The Healthplanfinder also provides speak to information and facts for navigators in dozens of languages.

Neil Angst is an insurance policies broker whose Everett organization, Health Insurance coverage Solutions NW, LLC, serves as an “enrollment center” for the health and fitness profit trade. Like navigators, brokers also offer you no cost guidance for all people, but they have much more experience on the nuances of purchasing for strategies. Brokers are compensated commissions by coverage providers when people today indication up for those people strategies.

Angst reported when the point out set up the trade, it needed some “brick and mortar” destinations wherever individuals could go for assistance, specially in communities with substantial uninsured populations. Angst carries on to have a number of people speak to him simply because of that listing on the Healthplanfinder internet site. He educates them about their health and fitness insurance coverage alternatives: “I actually love producing sure that the customer has appropriate info in buy to make that decision.”

Angst reported that the Cascade Treatment Discounts approach is the biggest adjust this year. Individuals more condition subsidies will allow lessen-money homes “to have more available care by preserving the price down.” Just pay awareness to which suppliers are in-network.

One more alter in 2023 is the repair of the “household glitch.” This was a “big hole” in the first Economical Care Act, Angst stated. It produced families ineligible for top quality subsidies on the trade if an employer available dependent coverage, even if that coverage was not very affordable for them.

Nationally, the Kaiser Spouse and children Foundation believed that 5.1 million men and women fell into the relatives glitch in 2021.

The Inflation Reduction Act, passed in August, fixes that. If the most inexpensive employer health and fitness approach would cost far more than 9.12{6f90f2fe98827f97fd05e0011472e53c8890931f9d0d5714295052b72b9b5161} of home money to deal with dependents, then all those family members customers can apply for exchange health and fitness plans with monetary aid.

Angst is advising his organization customers to make sure their workforce know about the changes and verify out their alternatives. But employer-based mostly designs can offer more price than exchange designs for persons with complicated health ailments. Angst also recommended employees need to do the math on any savings if they spend for employer-based mostly protection on a pre-tax foundation.

Certainly, some folks will nevertheless shell out full value for well being coverage, one thing they are no more time expected to have. And it can be a good deal of revenue.

Angst sees clients who are reluctant to fork out for health coverage. Some younger folks are inclined to imagine they are “Superman or Superwoman,” and for them the possibility of no insurance coverage feels value the gamble. “There’s most likely not much I can say to that person to justify a $350/thirty day period quality for catastrophic protection,” he said.

But for more mature folks, Angst urges warning: “You may possibly be the healthiest 55-12 months-aged individual on the world, but you will need to have some evaluate of protection so that if a little something terrible does take place, they’re not coming for your household.”

Adults who lacked wellbeing insurance policies for extra than 50 {6f90f2fe98827f97fd05e0011472e53c8890931f9d0d5714295052b72b9b5161} the yr were being noticeably far more most likely to have health-related debt of at minimum $250, in accordance to Kaiser Household Foundation’s assessment. Personal debt collectors for professional medical vendors can sue sufferers, major to garnished wages and liens on residences.

For her portion, Howe emphasised the value of insurance policy as a gateway to preventive care for purchasers and clients.

“Our objective, especially because we are a clinic,” she said, “is seriously to do all those preventive care providers, and to make certain that they they do have other choices than going to the ER and then getting to offer with these payments.”

Means:

Discover wellbeing designs and enable for comprehension the alternatives: wahealthplanfinder.org/

Workforce of accredited youngster treatment amenities might be eligible for $ every month rates once again in 2023: wahealthplanfinder.org/us/en/health and fitness-protection/who-can-indicator-up/kid-treatment-discover-more.html

Joy Borkholder is the well being and wellness reporter for The Day-to-day Herald. Her perform is supported by the Wellbeing Reporting Initiative, which is sponsored in aspect by Premera Blue Cross. The Day-to-day Herald maintains editorial manage about content material made as a result of this initiative.

Pleasure Borkholder: 425-339-3430 [email protected] Twitter: @jlbinvestigates.

More Stories

Empowering Independence: Enhancing Lives through Trusted Live-In Care Services

Major Mass., NH health insurance provider hit by cyber attack

Opinion | Health insurance makes many kinds of hospital care more expensive